san francisco sales tax rate breakdown

The current total local sales tax rate in san francisco ca is 8625. South San Francisco is located within San Mateo County California.

Top Earning New Yorkers Could Face 61 2 Combined Tax Rate Under House Plan

File Monthly Transient Occupancy Tax Return.

. The sales and use tax rate varies depending where the item is bought or will be used. San Francisco imposes a 14 transient occupancy tax on the rental of accommodations for stays of less than 30 days. Limited to 15 per year on the minimum base tax 30 per year on.

The San Francisco County Sales Tax is collected. To review the rules in California visit our state-by-state guide. The tax is collected by hotel operators and short-term rental hostssites and remitted to the City.

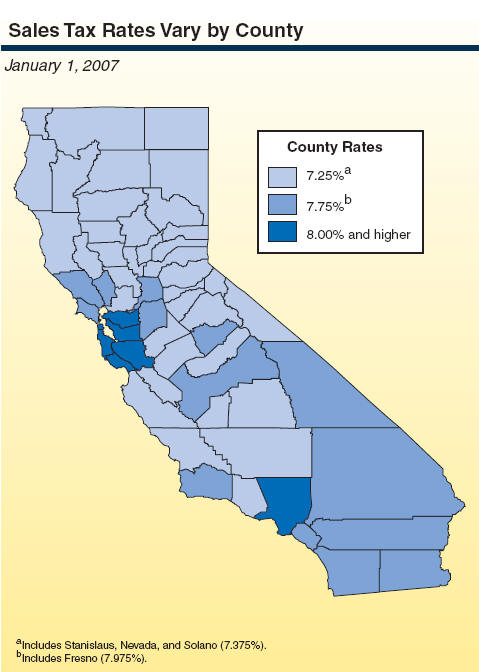

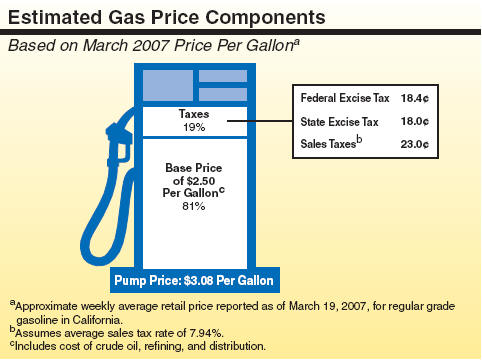

Has impacted many state nexus laws and sales tax collection requirements. 5110 cents per gallon of regular gasoline 3890 cents per gallon of diesel. District tax areas consist of both counties and cities.

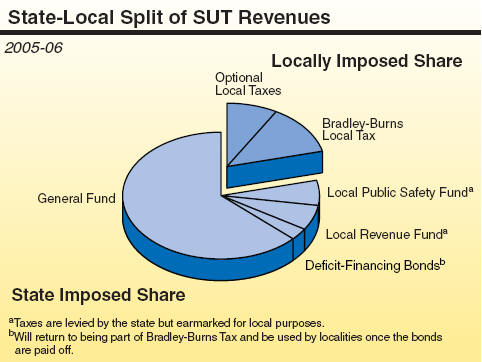

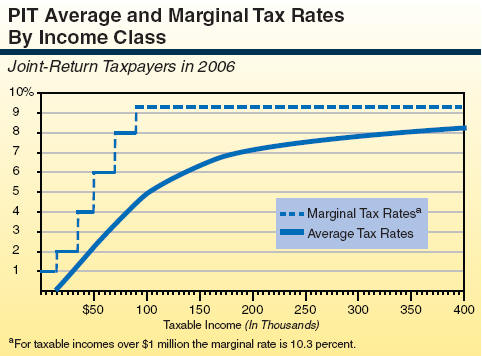

Where can my clients smoke. The state then requires an additional sales tax of 125 to pay for county and city funds. The California state sales tax rate is currently.

The average cumulative sales tax rate in South San Francisco California is 988. Within San Francisco there are around 39 zip codes with the most populous zip code being 94112. 2022 Estimated Income Tax Rates And Standard Deductions Cpa Practice Advisor Sales Tax By State Is Saas Taxable Taxjar.

A base sales and use tax rate of 725 percent is applied statewide. California Sales Tax. The San Francisco County sales tax rate is.

The 2018 United States Supreme Court decision in South Dakota v. San francisco sales tax rate breakdown Sunday March 20 2022 Edit. San francisco sales tax rate breakdown.

This includes the sales tax rates on the state county city and special levels. Since 1974 the San Francisco sales tax rate has increased eight times from 650 percent to the current rate of 850 percent. Automating sales tax compliance can help your business keep.

The sales tax rate does not vary based. Within South San Francisco there are around 2 zip codes with the most populous zip code being 94080. Property Tax Rate In Sf Slated To Drop Where The Dollars Will Go.

Therefore you will not be responsible for paying it. South Shore Alameda 10750. San Francisco has parts of it located within San Mateo County.

The sales tax jurisdiction name is San Francisco Tourism Improvement District which may refer to a local government division. The minimum combined sales tax rate for San Francisco California is 85. Sales Tax Breakdown.

The transient occupancy tax is also known as the hotel tax. 5110 cents per gallon of regular gasoline 3890 cents per gallon of diesel. In addition to the statewide sales and use tax rate some cities and counties have voter- or local government-approved district taxes.

The San Francisco County California sales tax is 850 consisting of 600 California state sales tax and 250 San Francisco County local sales taxesThe local sales tax consists of a 025 county sales tax and a 225 special district sales tax used to fund transportation districts local attractions etc. California City County Sales Use Tax Rates How Do State And Local Sales Taxes Work Tax Policy Center. There is no applicable city tax.

With local taxes the total sales tax rate is between 7250 and 10750. The homeownership rate in san francisco ca is 371 which is lower than the national average of. Ad Manage sales tax calculations and exemption compliance without leaving your ERP.

This includes the rates on the state county city and special levels. The average cumulative sales tax rate in San Francisco California is 864. Please visit our State of Emergency Tax Relief page for additional information.

073 average effective rate. South San Francisco 9875. Avalara provides supported pre-built integration.

The 8625 sales tax rate in San Francisco consists of 6 California state sales tax 025 San Francisco County sales tax and 2375 Special tax. The sales and use tax rate varies depending where the item is bought or will be used.

Why Are Taxes So High In Canada Quora

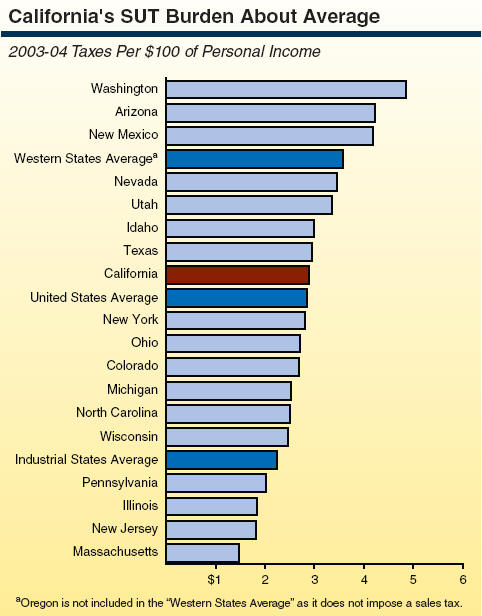

California S Tax System A Primer

How Can Crowdfunding Creators Prepare For Tax Day Backerkit

Why Are Taxes So High In Canada Quora

California S Tax System A Primer

Why Are Taxes So High In Canada Quora

California S Tax System A Primer

California S Tax System A Primer

Taxes In Orem Utah Orem Sales Tax Rates And Orem Property Tax Rates Orem Ut The Best Guide To Orem Utah

How To Calculate Sales Tax On Almost Anything You Buy

Sales Tax Collections City Performance Scorecards

California S Tax System A Primer

94110 Sales Tax Rate Ca Sales Taxes By Zip August 2022

Property Taxes Department Of Tax And Collections County Of Santa Clara

Why Are Taxes So High In Canada Quora

Top Earning New Yorkers Could Face 61 2 Combined Tax Rate Under House Plan

Tax Rates Which County In Your State Has The Highest Tax Burden

Why Is Tax In Canada So High Compared To That Of Houston Quora